Securing cheap SR22 car insurance is a significant hurdle for high-risk drivers. SR22 insurance costs significantly more than standard coverage, often hundreds of dollars extra per year. This article examines the factors influencing SR22 costs and provides practical strategies for finding affordable options, including exploring non-owner SR22 insurance.

Toc

- 1. Understanding SR22 Insurance in Kansas

- 2. Finding Cheap SR22 Car Insurance Near Me

- 3. Related articles 01:

- 4. Cheapest SR22 Insurance Kansas: Strategies for Lower Premiums

- 5. Cheap SR22 Car Insurance Progressive: A Closer Look

- 6. Non-Owner SR22 Insurance Kansas: Coverage Without a Car

- 7. Related articles 02:

- 8. Getting Your SR22 Requirement Removed

- 9. Current Trends in SR22 Insurance

- 10. Conclusion

Understanding SR22 Insurance in Kansas

What is SR22 Insurance?

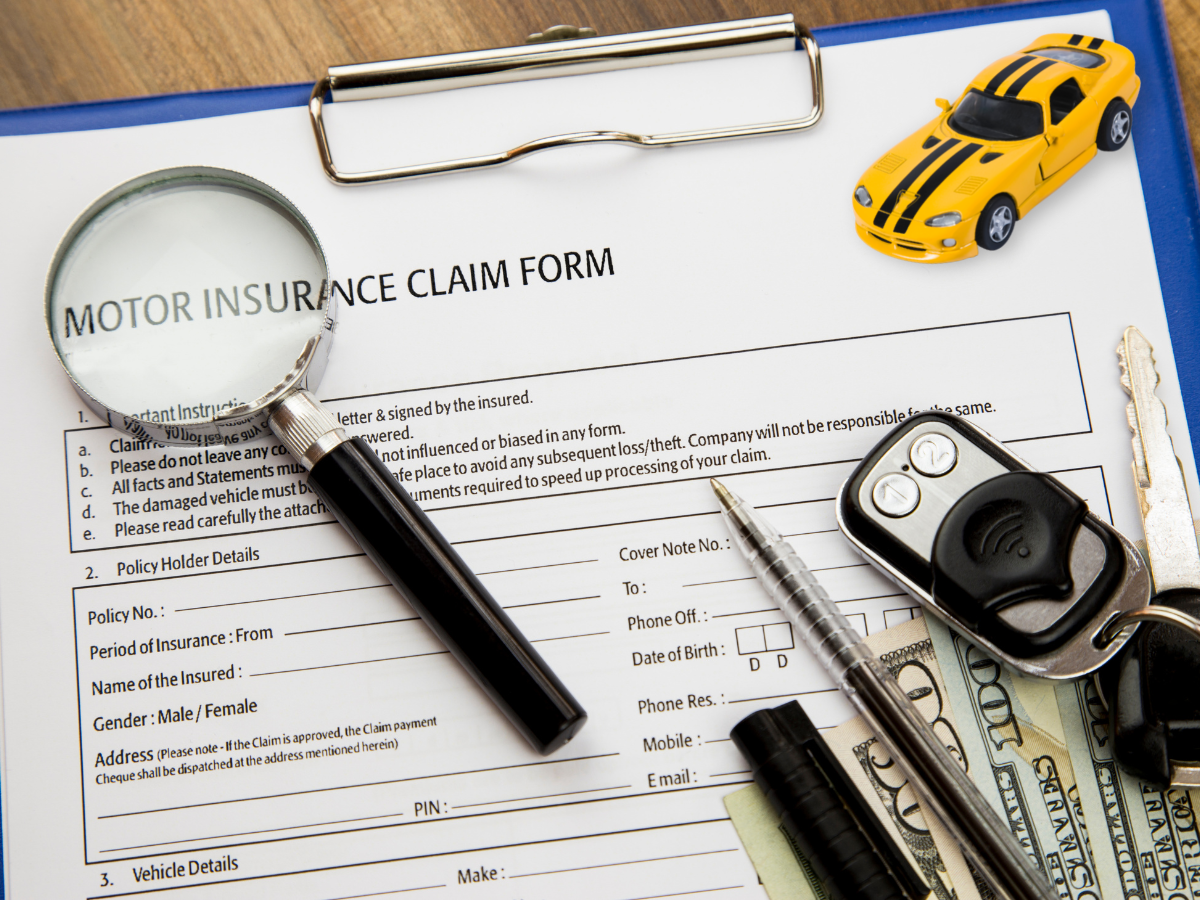

SR22 insurance serves as proof of financial responsibility mandated by the state. It’s essential for drivers who have committed significant violations, such as DUIs, multiple traffic infractions, or driving without insurance. Contrary to popular belief, SR22 is not a specific type of insurance policy; rather, it is a certificate that your insurance company files with the state to confirm that you meet the minimum liability coverage required.

Situations Requiring SR22 Insurance

Several scenarios can necessitate the need for SR22 insurance:

- DUI or DWI Convictions: A DUI or DWI can lead to severe penalties, including the requirement to file an SR22 to reinstate driving privileges.

- Accidents Resulting in Injury or Property Damage: If you cause an accident that results in injuries or damages, you may be required to obtain SR22 insurance.

- Multiple Traffic Violations: Accumulating several traffic tickets within a short period can lead to the state mandating SR22 coverage.

- Driving Without Insurance: If caught driving without valid insurance, you may need to file an SR22 to demonstrate financial responsibility.

In Kansas, failing to maintain an active SR22 can result in serious consequences, including the suspension of your driver’s license. Therefore, understanding the implications of your driving record is crucial for navigating insurance options effectively.

Consequences of Not Maintaining SR22 Coverage in Kansas

High-risk drivers in Kansas must be vigilant about maintaining their SR22 coverage. Failing to do so can lead to severe repercussions:

- License Suspension: If you do not keep your SR22 insurance active, your driver’s license may be suspended, making it illegal for you to drive.

- Increased Premiums: A lapse in coverage can also lead to increased premiums when you seek to reinstate your insurance.

- Legal Penalties: Driving without a valid SR22 can result in additional legal penalties, including fines and further restrictions on your driving privileges.

Differences Between SR22 and FR-44 Forms

While discussing SR22 insurance, it’s essential to mention the FR-44 form, which is required in some states, including Florida and Virginia, for more severe offenses. The FR-44 has stricter coverage requirements than the SR22, necessitating higher liability limits. Understanding these distinctions can help you navigate the insurance landscape more effectively.

Finding Cheap SR22 Car Insurance Near Me

Importance of Comparing Quotes

When searching for cheap SR22 car insurance, comparing quotes from multiple providers is crucial. This not only helps you identify the best rates but also allows you to evaluate the services and coverage options each insurer offers. With numerous companies in the market, it is essential to consider both national and local providers.

National Insurers to Consider

Several well-known national insurers provide SR22 coverage that you should explore:

- Progressive: Known for its competitive pricing and user-friendly online tools, Progressive SR22 insurance can be a viable option. They also offer various discounts that can help lower your premiums.

- Allstate: This insurer is recognized for its educational resources and efficient SR22 filing process, making it a strong contender for those seeking affordable coverage.

- Geico: With a reputation for low rates and good customer service, Geico is another solid choice for cheap SR22 car insurance.

- American Family: This company is noted for its bundling discounts, which can significantly reduce your overall insurance costs.

Evaluating Insurer Ratings

Before choosing an insurer, it’s essential to check their ratings from organizations like the NAIC (National Association of Insurance Commissioners) and AM Best. These ratings assess financial stability and customer service, ensuring you select a provider that will be reliable and responsive to your needs.

Local Insurers in Kansas

In addition to national providers, don’t overlook local insurance companies in Kansas. Regional insurers may offer more competitive rates and personalized service. For instance, companies like Kansas Farm Bureau Insurance and State Farm may have tailored options for high-risk drivers. Gathering quotes from both national and local companies ensures you are getting the best possible deal on your SR22 insurance.

2. https://namtienphong.vn/mmoga-find-cheap-car-insurance-in-iowa-a-guide-for-new-residents/

3. https://namtienphong.vn/mmoga-cheap-car-insurance-san-antonio-a-guide-to-finding-affordable-rates/

5. https://namtienphong.vn/mmoga-cheap-sr22-car-insurance-find-affordable-coverage-in-kansas/

Using Online Comparison Tools

The internet offers a plethora of resources for quickly comparing insurance quotes. Utilizing online comparison tools allows you to input your information and receive multiple quotes from various insurers. This method not only saves time but also enables you to find the cheapest SR22 car insurance near you. Additionally, some platforms specialize in high-risk driver insurance, providing insights into which insurers are more favorable for those with SR22 requirements.

Cheapest SR22 Insurance Kansas: Strategies for Lower Premiums

Bundling Insurance Policies

One effective strategy for reducing your insurance premiums is bundling your SR22 car insurance with other policies, such as home or renters insurance. Many providers offer significant discounts for bundling, leading to substantial savings over time. When requesting quotes, be sure to ask about bundling options to maximize your savings.

Improving Your Driving Record

Another way to potentially lower your SR22 insurance rates is by improving your driving record. Taking defensive driving courses can demonstrate your commitment to safe driving and may qualify you for discounts on your premiums. However, it’s essential to acknowledge that even with a perfect driving record after a major violation, SR22 premiums might remain high for the mandated period, as the violation stays on record. Maintaining a clean record during the SR22 requirement period is vital for transitioning back to standard rates once your obligation ends.

The Impact of Credit Scores

Your credit score can also significantly influence your SR22 insurance premiums. Some insurers use credit-based insurance scores to assess risk, meaning a higher credit score can lead to lower premiums. However, this practice is not universally applied and varies by state and insurer, so it’s essential to check the specific policies of potential providers.

Increasing Deductibles

Raising your deductibles is another tactic that can help reduce your premiums. Although this means you’ll pay more out-of-pocket in the event of a claim, it often results in lower monthly payments. Carefully weigh the risks and benefits before making this decision, as it may not be suitable for everyone. While higher deductibles lower premiums, they can also increase out-of-pocket costs in case of an accident, potentially creating financial hardship for some drivers.

Exploring Usage-Based Insurance Options

Many insurers now offer usage-based insurance programs that monitor your driving habits through telematics devices. If you demonstrate safe driving behavior, you could benefit from lower premiums. This option can be particularly advantageous for high-risk drivers committed to improving their driving practices.

Regularly Shopping for Insurance

The importance of shopping around cannot be overstated. Insurance rates can fluctuate significantly from year to year, making it essential to compare quotes regularly. Aim to evaluate your options at least annually or even more frequently, especially if your circumstances change or if you have improved your driving record.

Cheap SR22 Car Insurance Progressive: A Closer Look

Evaluating Progressive’s SR22 Offerings

Progressive stands out in the market for cheap SR22 car insurance due to its user-friendly online tools and competitive pricing. However, potential customers should consider both the pros and cons of their offerings:

Pros:

- Competitive Pricing: Progressive often provides some of the lowest rates for SR22 insurance, making it an attractive option for budget-conscious drivers.

- Discount Opportunities: They offer various discounts that can help lower premiums, such as multi-policy discounts and safe driver discounts.

- Comprehensive Online Tools: Progressive’s website includes a variety of resources, including a quote comparison tool and educational materials on SR22 insurance.

Cons:

- Customization Limitations: Some users report limitations regarding customization options in their policies, which may not suit everyone’s needs.

- Variable Customer Service Experiences: Customer service experiences can vary, so it’s advisable to read reviews and consider your preferences when evaluating this option.

Comparing Progressive’s Pricing and Features

When comparing Progressive’s SR22 insurance with other major providers, consider the coverage options, premium rates, and customer service ratings. While Progressive may excel in pricing, other insurers like Allstate and Geico may offer additional resources or features that better align with your needs.

User Reviews and Experiences

User experiences with Progressive SR22 insurance can provide valuable insights. Many customers appreciate the ease of use and affordability but have noted mixed reviews regarding customer support. Before committing, it’s wise to read user reviews to gauge the overall satisfaction level.

Non-Owner SR22 Insurance Kansas: Coverage Without a Car

What is Non-Owner SR22 Insurance?

Non-owner SR22 insurance is designed for drivers who do not own a vehicle but still need to file an SR22. This type of insurance provides liability coverage when driving rental cars or vehicles owned by others. It is a crucial option for high-risk drivers who may need to demonstrate financial responsibility without owning a car.

1. https://namtienphong.vn/mmoga-cheap-sr22-car-insurance-find-affordable-coverage-in-kansas/

3. https://namtienphong.vn/mmoga-find-cheap-car-insurance-in-iowa-a-guide-for-new-residents/

5. https://namtienphong.vn/mmoga-cheap-car-insurance-san-antonio-a-guide-to-finding-affordable-rates/

Cost Comparison: Non-Owner vs. Standard SR22 Insurance

Typically, non-owner SR22 insurance is less expensive than standard SR22 insurance because it covers only liability and does not include physical damage coverage for a vehicle you own. The costs can vary, but expect to pay between $15 and $25 for the SR22 filing itself, with the overall insurance premiums being slightly higher than regular non-owner insurance. Even with non-owner SR22 insurance, drivers might still face higher premiums compared to those with clean records. For example, a driver with a DUI may pay around $50 per month for non-owner SR22 insurance, while a driver with a clean record may only pay $25 for a similar policy.

Obtaining Non-Owner SR22 Insurance Online

Finding non-owner SR22 insurance online is a straightforward process. Many insurers allow you to purchase this type of policy easily through their websites. When applying, ensure that you provide accurate information to avoid any issues with policy cancellation.

Eligibility Requirements for Non-Owner SR22 Insurance

It’s essential to understand the eligibility requirements for non-owner SR22 insurance. If you live in a household with someone who owns a vehicle, you may not qualify for non-owner SR22 insurance. Understanding these nuances is crucial to secure the right coverage.

Resources for Non-Owner SR22 Insurance Online

To find the cheapest non-owner SR22 insurance, consider using online comparison tools that specialize in high-risk drivers. These platforms can provide insights into which insurers are more favorable for non-owner SR22 requirements, making your search more targeted and effective.

Getting Your SR22 Requirement Removed

Steps to Get Your SR22 Removed

Once you have fulfilled the mandatory period for your SR22 insurance, typically ranging from two to five years, you can begin the process of having it removed. This involves contacting your insurance provider to inform them of your eligibility. They will then file an SR-26 form with the state, indicating that you no longer need the SR22.

Understanding the SR-26 Form

The SR-26 form is vital in the process of removing your SR22 requirement. It serves as a notification to the state that you have fulfilled your SR22 obligations, and it officially requests the lifting of the requirement. Ensure that you follow up with your insurer and the state DMV to confirm that the SR22 requirement has been officially lifted from your record.

Maintaining a Clean Driving Record

To ensure a smooth transition away from SR22 requirements, it is vital to maintain a clean driving record throughout the mandated period. Any violations during this time could extend your requirement for SR22 insurance. Additionally, be aware of the consequences of failing to maintain coverage or filing the necessary paperwork.

Kansas DMV Resources

For additional information and resources regarding SR22 insurance and the removal process, visit the Kansas Department of Revenue’s Division of Vehicles website. They provide comprehensive guidelines on SR22 requirements, including necessary forms and contact information for assistance.

Current Trends in SR22 Insurance

As technology evolves, the insurance industry is experiencing significant shifts, especially in how SR22 insurance is assessed and priced. One notable trend is the increasing use of telematics in SR22 insurance. Insurers utilize driving data to assess risk more accurately, and safe driving behaviors can lead to potential discounts. This trend is becoming increasingly popular among insurers, offering new opportunities for high-risk drivers to lower their premiums based on actual driving habits rather than solely on historical data.

Conclusion

Finding cheap SR22 car insurance in Kansas requires thorough research and planning. By understanding your needs, comparing providers, and utilizing cost-saving strategies, you can secure affordable coverage. Remember to maintain a clean driving record and proactively manage your insurance to ensure a smooth process. Start comparing quotes today to find the best SR22 insurance for your situation, and consider both national and local options to maximize your savings. As the industry continues to evolve, staying informed about trends like telematics can also provide additional opportunities for savings and better coverage.